The falls in Chinese stock markets have drawn attention to the role of derivatives in worsening the losses, specifically a species known as “snowballs” (雪球). These derivatives are also known as “auto-callables”, in some markets.

Snowballs are products sold to retail investors, which operate by providing a coupon, akin to a bond payment, that pays out unless and until markets fall beneath a certain, designated threshold, known as a “knock-in”.

At that point, brokerages sell their related future positions. In that sense, they recall put options, and are essentially bets that interest rates will fall, and markets will rise, or at least stay above the knock-in levels.

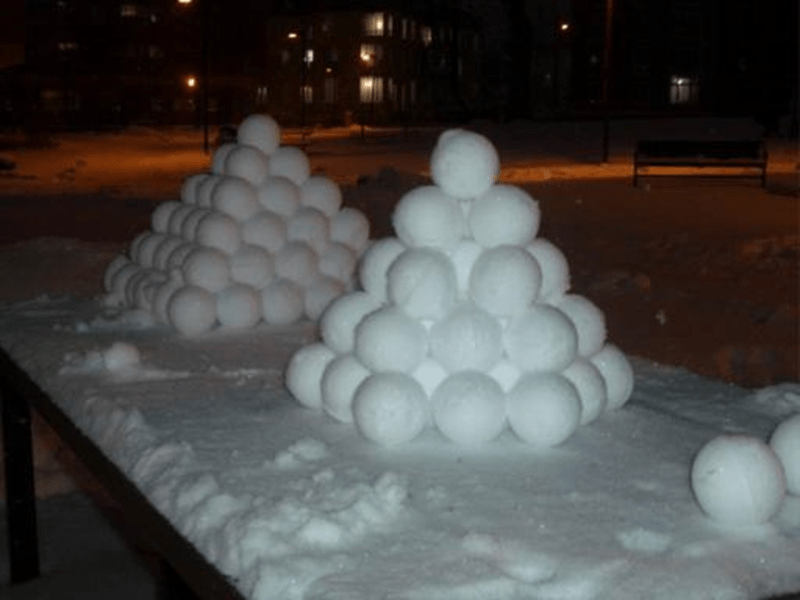

Snowballs

Another wealth management product

These products had proven popular amongst Chinese investors in recent years, as they offer a higher potential yield, by virtue of the coupon paid (sometimes 8% to 10%). However, they also lock in and magnify losses in the market, as many are sold at the same time, reinforcing market declines.

UBS has claimed that the value of snowballs in the Chinese markets may amount to USD50 billion, and that 40% of knock-in levels have been hit, as of 24 January 2024. Many of the knock-ins are set at about 4,865 for the CSI500 and 4,997 for the CSI1000.

Cinda Securities has also noted that every 100-point decline in the CSI 500 results in CNY5 billion of snowballs reaching lock-in levels, and in the CSI 100 results in CNY10 billion reaching that level.

Some reports have suggested that comparable products are affecting the Hang Seng Index, too, which are known as callable bull-bear contracts (“CBBCs”). These instruments track the index, but are leveraged to benefit from rising markets.

Again, investors sell out automatically when a particular level is hit. If there is insufficient demand in the market (as now), then prices as a whole go down, in a self-reinforcing effect.

Historical parallel

The snowballs are playing a role comparable to that of investment trusts in the 1929 stock market fall in the US.

Those investment trusts often held shares in other investment trusts, often purchased through leverage, resulting in a pyramid structure that encouraged expansion on the way up, but also resulted in a much more dramatic contraction on the way down.

Such appears to be what is happening now in Chinese market.

Broader implications

And as noted previously, these slides in the Chinese stock market may also mark the last gasp of the policy settlement that emerged in China in the 1980s – a mix that underpinned one of the most rapid periods of growth in economic history.

Leave a comment